Why Today’s Housing Market Isn’t the Same as the “Unicorn” Years

When it comes to real estate, looking back at numbers from different years can be helpful—but only if the comparison is fair. The years 2020 through 2022 were anything but normal. The housing market during that time was fueled by extraordinary circumstances, making them what many call “unicorn years.” Trying to measure today’s market against those unique years doesn’t give an accurate picture.

Here’s why it’s better to look at today’s housing market in context with pre-2020 conditions instead.

Buyer Demand Today is Still Higher Than Before the Pandemic

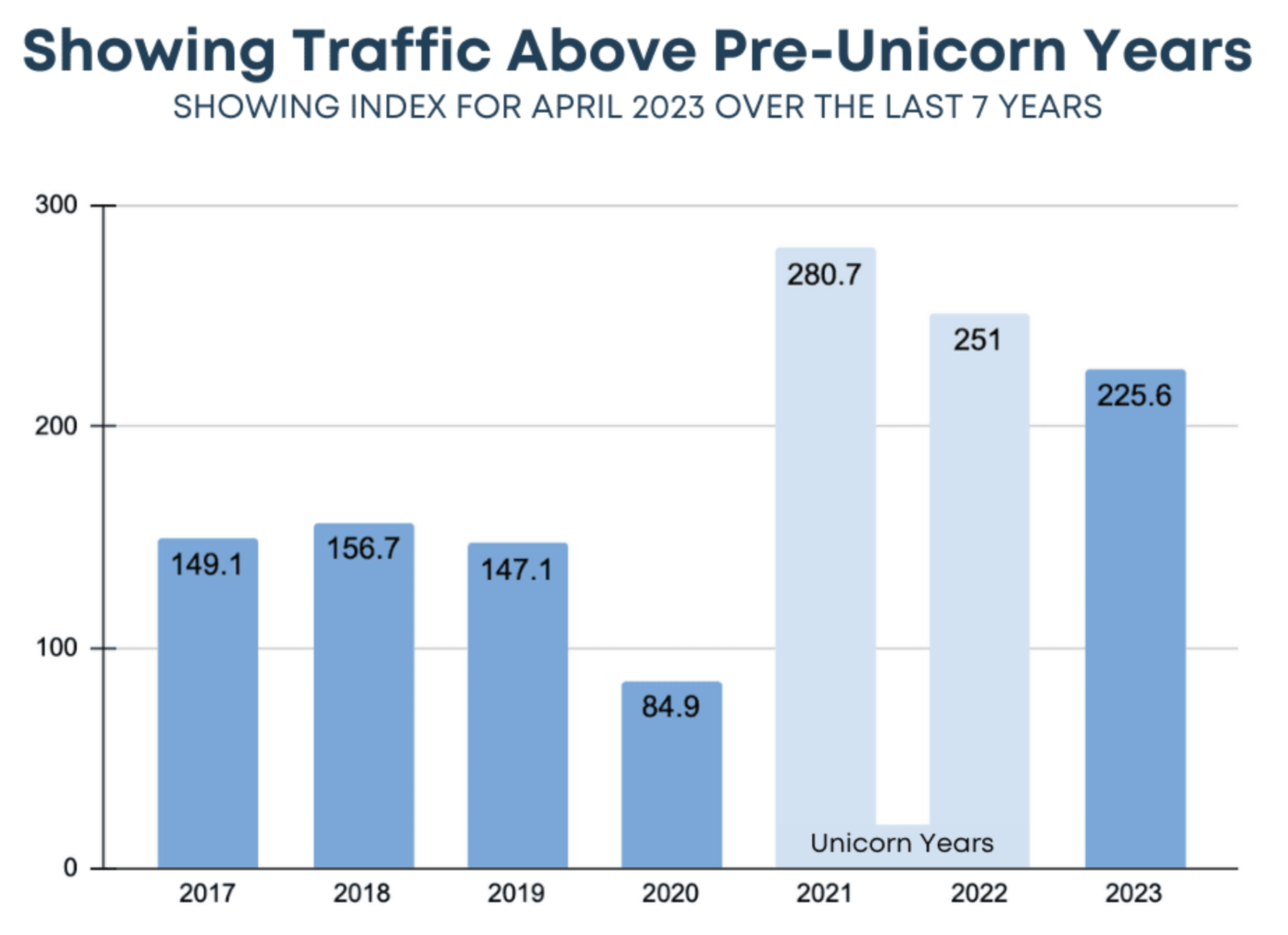

It’s true—buyer activity has cooled compared to the frenzy we saw in 2020–2022. But compared to the years before the pandemic, buyers are still much more active.

Before 2020, the average buyer activity index was around 151.

Today, it’s sitting closer to 225—more than a 50% jump from those earlier years.

That means even though things feel quieter than they did at the peak of the unicorn years, buyer demand is still much stronger than the steady, predictable market of the past. The shift in how people value their homes—looking for more space, comfort, and flexibility—has kept overall demand healthier than before the pandemic.

Home Prices Are Adjusting, Not Crashing

There’s been plenty of talk about price drops, but the reality is more balanced than the headlines suggest. What we’re seeing right now isn’t a housing crash—it’s a return to a steadier pace of appreciation.

During the unicorn years, prices soared at an unsustainable rate. Now, values are settling back into a more normal growth pattern. This kind of moderation is healthy. It gives both buyers and sellers a more predictable market and keeps long-term stability in check.

Foreclosures Remain Historically Low

Yes, foreclosure filings have inched up compared to the past couple of years, but they’re still far below typical levels. Right now, foreclosure activity is about 46% lower than the average between 2017 and 2019.

Why so low? Pandemic-era protections—like forbearance programs, foreclosure moratoriums, and government stimulus—helped homeowners avoid distress sales and stabilize financially. Even today, most homeowners have significant equity, which continues to shield the market from any wave of foreclosures.

The Bottom Line

The past few years were shaped by once-in-a-lifetime circumstances that created a very unusual real estate market. Comparing today’s numbers to those unicorn years will almost always make things look worse than they really are.

When you compare today to the market before the pandemic, the picture changes:

Buyer demand is still about 50% stronger than pre-2020.

Prices are growing at a sustainable pace instead of spiking.

Foreclosure activity remains much lower than historic averages.

The housing market today is not crashing—it’s normalizing. If you’d like a clear look at what’s really happening, let’s connect and talk through the numbers that matter most for you.